Tax Season officially opens January 24 and United Way of Lee, Hendry, and Glades’ free tax filing assistance program is ready to assist Southwest Florida residents keep more of their hard-earned money. The United Way VITA (Volunteer Income Tax Assistance) program provides free federal tax filing services at over 22 sites in Lee, Hendry, Glades, and Charlotte Counties to individuals and families making less than $66,000 per year. This program will be a valuable resource during the 2022 filing season to many of whom were hard hit by the pandemic and continue to struggle with having enough resources to meet their financial obligations.

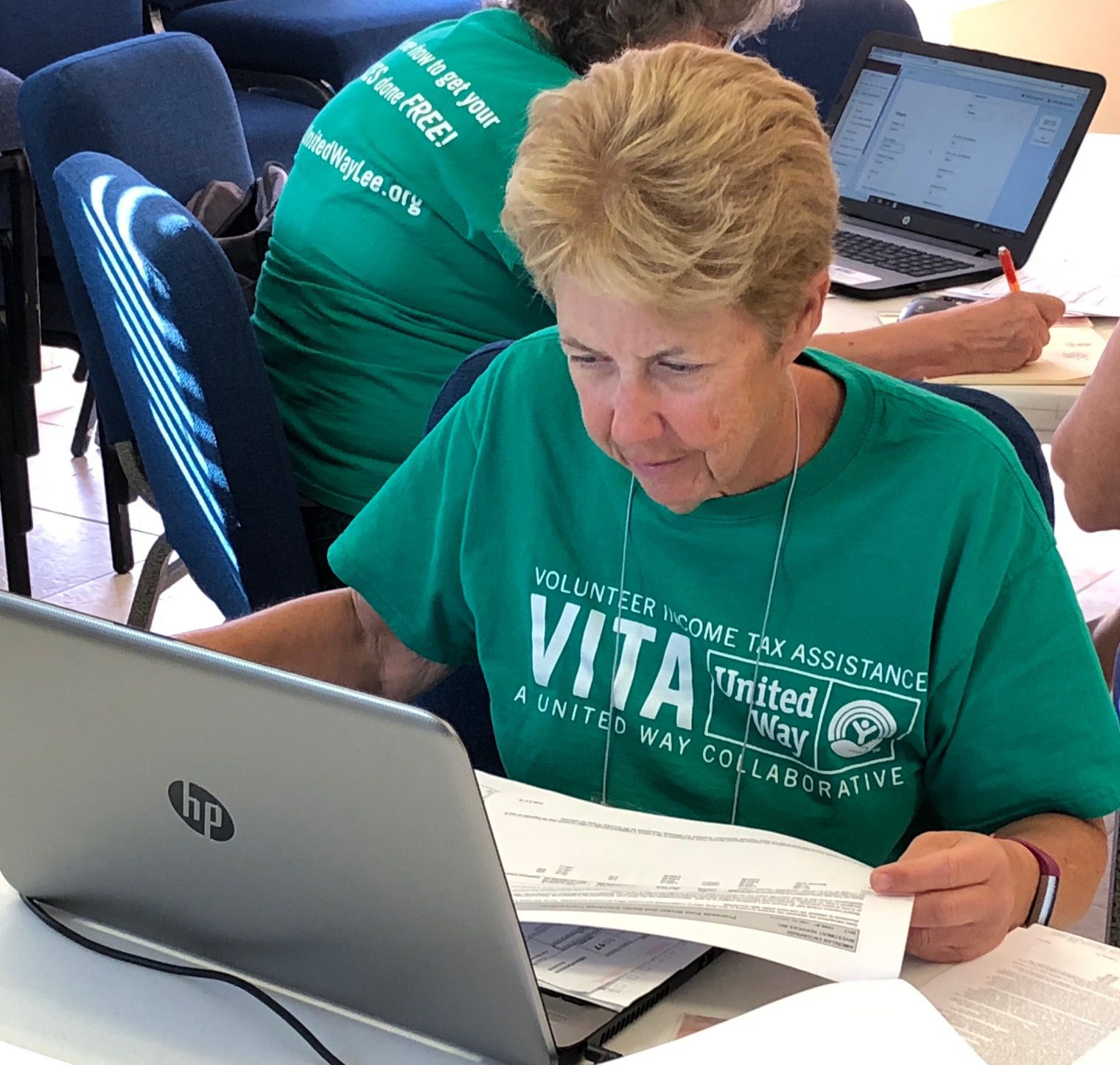

Each tax return is prepared by an IRS certified VITA volunteer who must pass an annual, comprehensive exam before preparing a single tax return. They are trained to determine if the taxpayers are eligible for the Earned Income Tax Credit (EITC), recovery rebates, education credits, child tax and/or childcare credits.

It is suggested that clients bring both their 2019 and 2020 tax returns to this year’s appointments along with:

- Total Amount of any Advanced Child Tax Credits received July-December.

- Total paid to day care provider and their tax ID number, name and address—even if taxpayers haven’t been able to claim the credit in the past.

- Amount of 3rd stimulus payment –issued mid-March 2021 to persons who qualified.

- Total cash donations for Charitable Contributions. Taxpayers can deduct up to $300 for cash contributionsto qualifying charities ($600 for married couples filing jointly).

“Despite many challenges last year, over 7,025 individuals and families were served by our dedicated volunteers through the free United Way VITA tax preparation program,” said Jeannine Joy, United Way CEO and President. “Client refunds combined with volunteer time, and tax preparation fees saved, resulted in a $12 Million impact to our local economy.”

Taxpayers who prefer a no contact option can e-file themselves free of charge with MyFreeTaxes.com or they can let our virtual VITA volunteers file their return online through GetYourRefund.org/uwlee It is simple and secure while offering online assistance with the process. Tax filers answer simple questions about their situation, securely upload their tax documents. The VITA team remotely prepares the tax return, speaks with the tax filer to review their return, and files the return with the tax filer’s consent.

To locate the most convenient VITA site and schedule an appointment visit: Unitedwaylee.org/freetaxprep or call the United Way 211 Helpline by dialing 2-1-1 or 239.433.3900.