Tax Season officially opens on January 22nd and the United Way of Lee, Hendry, and Glades free tax filing assistance program is ready to assist Southwest Florida residents in keeping more of their hard-earned money. The United Way Volunteer Income Tax Assistance (VITA) program provides no-cost federal tax filing services at over 25 convenient locations. This year, the program expands its reach to include Immokalee in Collier County, while still serving Lee, Hendry, Glades, and Charlotte counties.

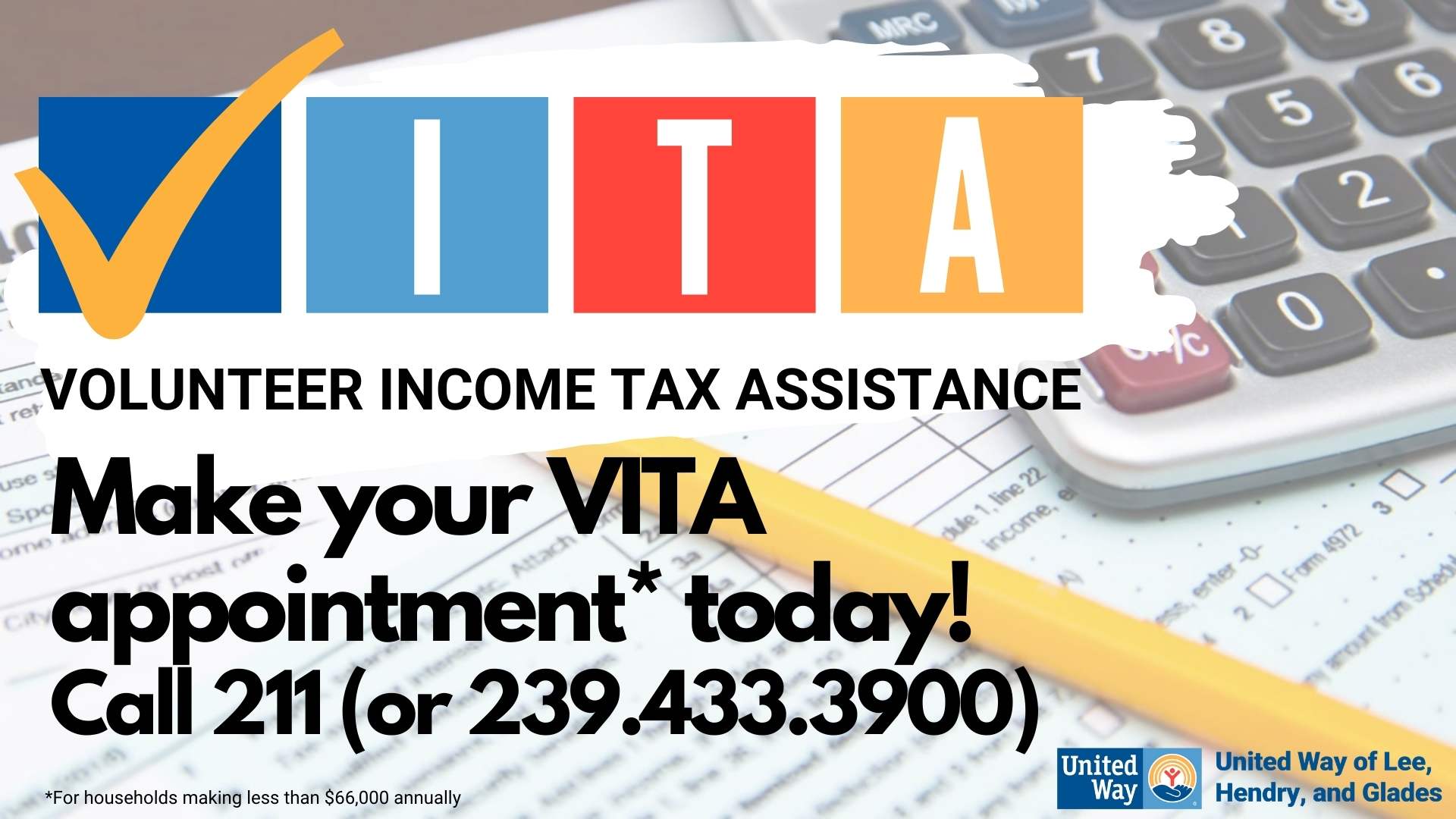

Eligibility for the VITA program is extended to individuals and families earning less than $66,000 annually. Additionally, self-employed individuals with expenses under $35,000, and no business loss, depreciation, or employees, are encouraged to take advantage of this free service.

Each tax return is prepared by an IRS certified VITA volunteer who must pass an annual, comprehensive exam before preparing a single tax return. They are trained to determine if the taxpayers are eligible for the Earned Income Tax Credit (EITC), education credits, child tax and/or dependent care credits.

“We recognize the significant impact that tax credits and deductions have on an individual’s tax bill or refund,” stated Patrice Cunningham, Vice President of the Volunteer Center. “Our experienced volunteers actively educate clients on identifying eligible credits and deductions, underscoring the crucial role they play. Tax credits, particularly those like the Earned Income Tax Credit, directly reduce the tax bill on a dollar-for-dollar basis and can even lead to a refund.

This crucial service empowers clients by granting access to vital tax assistance, resulting in an average savings of $300 per tax return. Last year alone, it saved $2.2 million in tax preparation fees in our community, redirecting these funds towards essential needs like food, medical care, and housing.”

To locate the most convenient VITA site and schedule an appointment visit: Unitedwaylee.org/freetaxprep or call United Way’s 211 helpline by dialing 2-1-1 or 239.433.3900.

Taxpayers can also e-file themselves free of charge with MyFreeTaxes.com or let our virtual VITA volunteers file their return online through GetYourRefund.org/uwlee It is simple and secure while offering online assistance with the process. Tax filers answer simple questions about their situation and securely upload their tax documents. The VITA team remotely prepares the tax return, speaks with the tax filer to review their return, and files the return with the tax filer’s consent.

For more information on United Way’s Volunteer Income Tax Assistance (VITA) program, including a list of locations and eligibility requirements, please visit Unitedwaylee.org/freetaxprep.