United Way offers 2 FREE tax preparation programs to serve SW Florida!

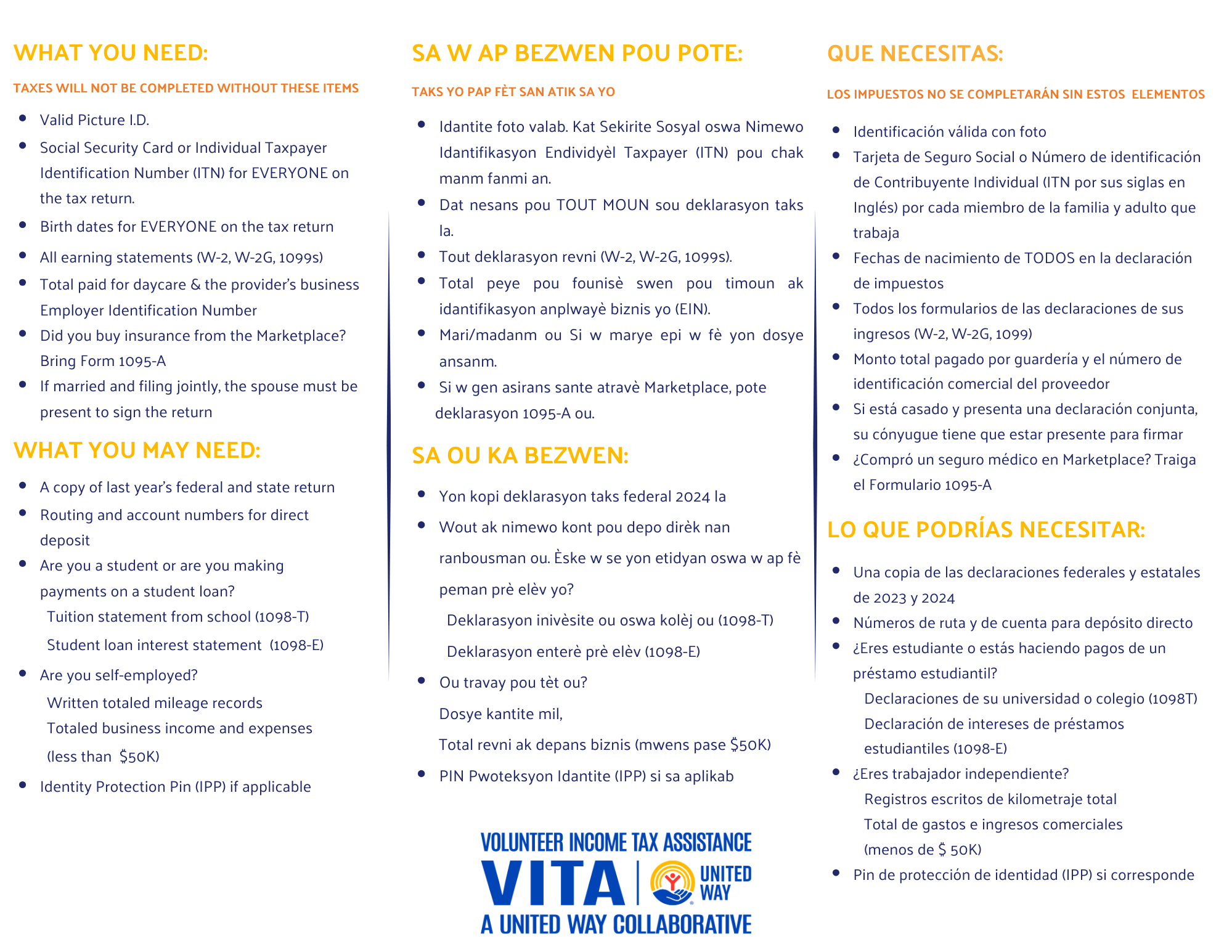

You can have your federal tax return prepared, e- filed and direct deposited for FREE by United Way’s IRS-certified volunteers who are passionate about taxes. Volunteers will determine if you are eligible for the Earned Income Tax Credit (EITC), Child Tax Credits, Childcare Credits and/or Education Credits when you file.

Please note: we do simple returns. We cannot do returns that have rental income; or self-employment income at a loss, with expenses that exceed $50,000, have business use of the home, or with employees. Please call 211 (or 239.433.3900) to see if you qualify.

Choose an Option That Is Right For You

- File Yourself – Have a simple tax return and a computer? You can file yourself for FREE. All you need is the AGI (Adjusted Gross Income) amount from last year’s return. Click here to file with MyFreeTaxes.com

- Upload your Documents to a secure site– with Get Your Refund, complete an online intake form and scan or upload photos of your tax documents into a secure account where our United Way certified VITA Volunteers will complete your tax return remotely. Program begins January 26th. Getyourrefund.org/uwlee

- Schedule an appointment at one of our tax sites. See the list of tax sites below. Please pay careful attention to the description of the sites listed below—some do offer traditional face-to-face appointments while others only offer drop-off/pick up tax appointments.

Book your appointment by clicking the link below or call 211 or (239) 433-3900

Resources

Offers 100% virtual tax prep services, it’s the same service you’ve always received from our certified volunteers – except no in-person contact. It is safe and secure and can be completed using your smart phone or computer.

Prepare and e-file your own federal and state taxes safely, conveniently and FREE online.

File for an extension from the IRS.

Check with the IRS to find out the status of your refund. You will need your SS#, Filing Status, and exact refund amount to track your refund status.